· deep dive · 4 min read

Amazon vs SpaceX: The Battle for the Best Satellite Internet Service

SpaceX and Amazon Are Playing for Keeps to Control Satellite Broadband and Connect the World. But Is There Room for Both in the Orbit?

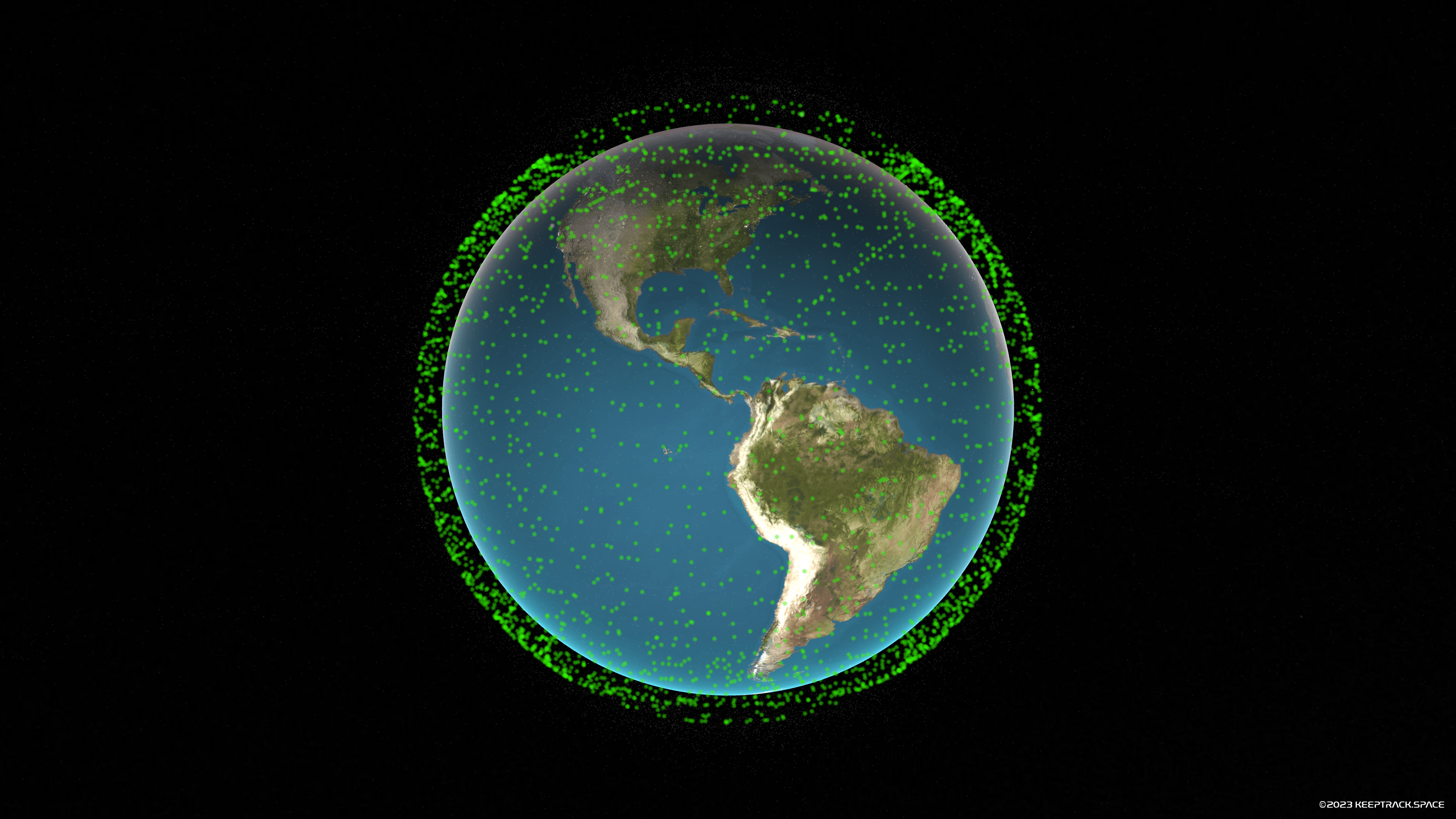

High above Earth, two corporate titans are engaged in a high-stakes battle to blanket the planet in satellite broadband coverage using low earth orbit (LEO) satellites. Amazon and SpaceX aim to build unrivaled megaconstellations providing internet for tens of millions lacking access. Though they share this vision of connecting the world from space, their approaches differ significantly.

Amazon’s Ambitious Project Kuiper

E-commerce giant Amazon stormed onto the scene in 2019 by announcing Project Kuiper, named for the icy Kuiper Belt beyond Neptune. Though details remain scarce, Amazon intends to launch 3,236 LEO satellites between 590-630 km high to deliver broadband internet. Regulatory approval from the FCC came with the requirement that Amazon deploy half its satellites by 2026, completing full deployment before 2029.

To meet these tight deadlines, Amazon has contracted multiple launches, including nine missions aboard United Launch Alliance’s Atlas V rockets. It has also purchased three 2025 Falcon 9 flights from rival SpaceX, supplementing capacity amidst a crowded manifest. Experts estimate implementation costs may top $10 billion, though Amazon has not released an official budget.

Key Project Kuiper Details:

- Aims to provide broadband access to tens of millions globally using LEO satellites

- FCC timeline requires 50% deployment by 2026, 100% by 2029

- Purchased 3 launch contracts from rival SpaceX

- First two test satellites launched in 2021

Network expected to support Amazon Web Services, Prime Video, Alexa In 2021, Amazon launched two experimental satellites to validate systems before full deployment. When complete, Kuiper promises affordable, high-quality broadband to consumers and Amazon businesses like AWS cloud computing. However, service pricing and availability remain unpublished. See the world from space with the best satellite tracking app.

SpaceX’s Starlink Charges Forward

Meanwhile, SpaceX has raced ahead with its own Starlink internet constellation, announced in 2015. Led by irreverent CEO Elon Musk, the program will require up to 42,000 LEO satellites flying between 340-570 km high. The network has already grown rapidly to over 5,100 spacecraft as of late 2022 — more than any competitor.

Key Starlink Details:

- Over 5,100 satellites launched already

- Public beta began serving test users in 2020

- Delivers 200+ Mbps speeds with sub-20 ms latency

- Expanding user pool to over 538,000 customers globally

- New satellites feature laser links for more connectivity

SpaceX’s status as the world’s leading private launch provider has enabled its headstart. Repeated Falcon 9 missions efficiently carry 60 Starlink satellites each to orbit. With coverage rapidly improving, Starlink promises high-speed, low-latency connections almost anywhere on Earth. Starting in late 2022, new satellites feature laser links, reaching more remote users without ground stations.

While financial details remain private, SpaceX intends Starlink subscriptions to fund future Mars ambitions. Despite lofty goals, attracting over half a million users across 25 countries is no small feat. As service expands, Starlink expects to achieve global coverage. You can track their progress live with our satellite tracking app.

Which Megaconstellation Will Dominate?

Project Kuiper and Starlink ultimately share the goal of connecting the unconnected, even if their leaders spar publicly on X, formerally Twitter. Tens of billions of dollars have been poured into these dueling low earth orbit megaconstellations — an infrastructure investment sure to shape the internet for decades.

Of course, challenges abound when installing technology across hundreds or thousands of precision spacecraft operating in the harsh environment of space. But perhaps the biggest obstacle is Earthly red tape — securing steady launch access plus wireless spectrum licenses across the patchwork of global regulators. SpaceX maintains a headstart here with rockets already certified.

As milestones accumulate, neither player looks poised to achieve total domination. Expect both networks to coexist serving internet subscribers by mid-decade. The biggest questions now are coverage, pricing, and performance. With affordable global broadband long considered impossible, realization of this shared dream should be considered a human triumph — no matter your tech allegiance.